You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

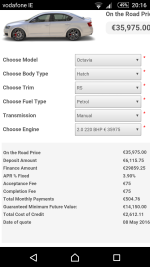

PCP Finance

- Thread starter PMwrx

- Start date

http://www.irishtimes.com/life-and-...-make-sure-you-read-the-small-print-1.2111461

few pros and cons there

few pros and cons there

MicksGarage.com

New member

Edited

If you are doing over 20k klms a year don't even consider it, they want those cars back with as low mileage as possible for resale with meaty penalties if you do want to give back or trade in at the end of 3 years. Some charge 0.15c per klm over the threshold set at the start which adds up if you go to hand back. Residual value at the end of the 3 years is at the mercy of the garage, had one garage honestly say " depends on how good I am to you after the 3 years are up" told him to f&@k off and went for the Audi with standard few bob from bank loan instead. Pros are low payments if your mileage is under 20k say, usually free servicing as they want to be sure that they are serviced on time, 5 year warranties and sure you would be driving a brand new car knowing you will have a new one again in a few years. Be prepared to cough up/trade in up at least 10k to make monthly payments affordable on say a 30k car.

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Last edited:

Pcp is like intrest only mortgage. . Yes it's a cheap way to finance a car as the repayments are so low but really your stuck with that brand with The balloon payment at the end or hand it back and have nothing . also the servicing costs are mental and there are no ways around it . Not something I'd ever go for to be honest

Pcp is like intrest only mortgage. . Yes it's a cheap way to finance a car as the repayments are so low but really your stuck with that brand with The balloon payment at the end or hand it back and have nothing . also the servicing costs are mental and there are no ways around it . Not something I'd ever go for to be honestmidlandbe5

Octane Boostaholics

keith dublin

Member Number 161Full ISDC Members 2015

Madness I think I'd rather knock around in an old car

And put the money into something you will have forever like extension on your house

Or a nice plot in your local graveyard lol

And put the money into something you will have forever like extension on your house

Or a nice plot in your local graveyard lol